How Vertical Drama Is Reshaping Mobile Entertainment in 2025

Vertical drama—native 9:16 series with 1–3 minute chapters—is no longer a social experiment. It’s a mobile-first format with its own story grammar, economics, and platforms.

- Mobile-first audiences & micro-binge

- Native 9:16 (not cropped)

- Retention > raw views

What’s changed

- Micro-binge habits fit 1–3 min episodes

- Apps optimize for completion

- Discovery borrows “shorts/feeds”

Why it works

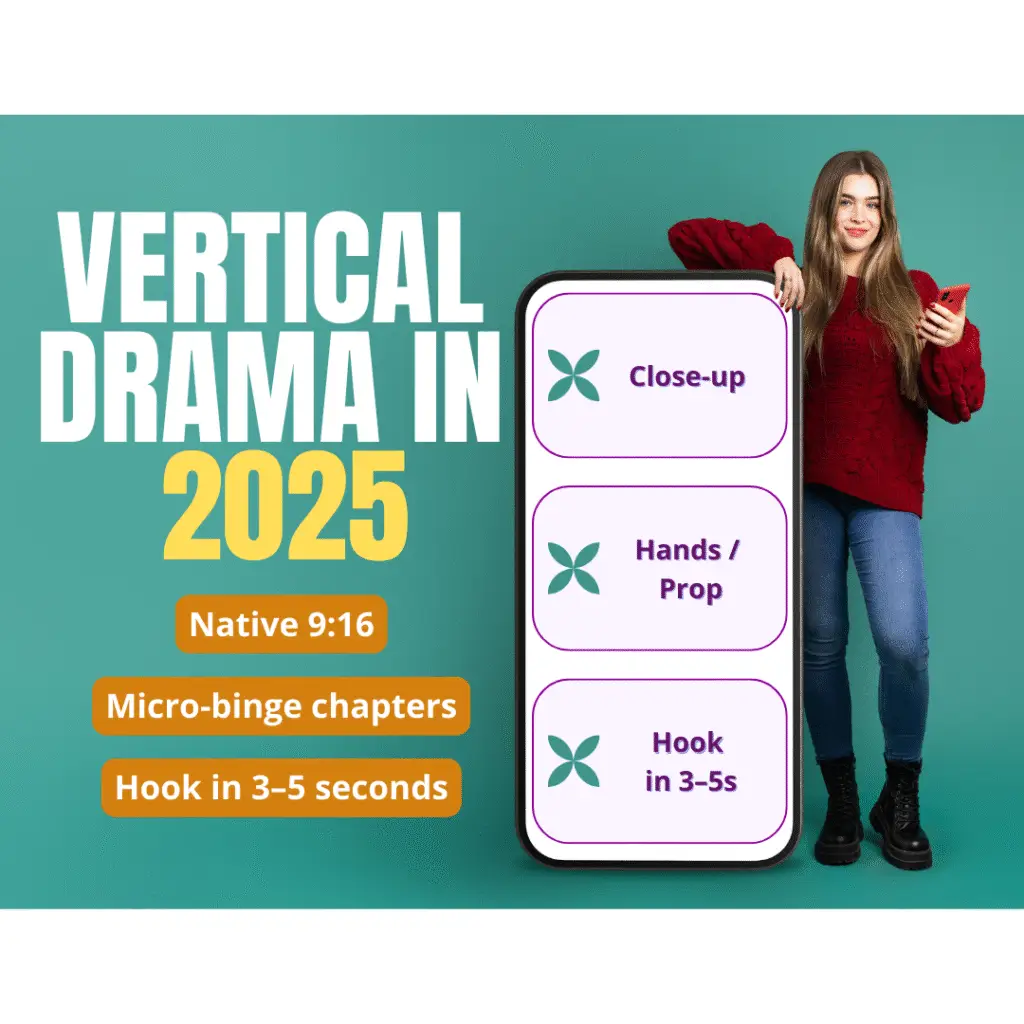

- Hooks in 3–5 seconds

- One beat per episode

- Intimate, legible 9:16 framing

Economics

- Location radius ↑ usable minutes/day

- Long seasons, short chapters

- Learning compounds across titles

What’s happening in 2025

- Mobile-first viewing and micro-bingeing define consumption patterns.

- Dedicated vertical-drama apps compete on retention and pay-through.

- Generalist platforms adopt “shorts-like” discovery for drama.

- Production adapts: compact schedules, reusable sets, fast editorial cycles.

- Global expansion: Asia → US/EU/India, with local genres and remakes.

Data Snapshot

- Growing installs and in-app purchases across leading micro-drama apps

- Seasonal drops offset by hit-driven spikes

- Regional charts vary by UA campaigns and local genres

Case patterns

- Long seasons (e.g., 60–90 eps) with small-chapter cadence

- Monetization via coins/tickets + ad watch + bundle passes

- Editorial learning improves retention across multiple titles

3–5s hook

- Stage a clear conflict or reveal

- Make the consequence explicit

- Cut into action (avoid slow ramps)

One beat per episode

- Resolve a mini-action each chapter

- End with a promise/cliffhanger

- Keep momentum (tap-to-next)

Legibility by design

- Center-weighted blocking for faces/hands

- Subtitles high-contrast & mobile-safe

- Wardrobe/art that reads in 9:16

Unit Economics (How Teams Plan)

| Signal | Why it matters | How to optimize |

|---|---|---|

| Usable minutes per day | Real output vs. time lost in transfers and resets. | Tight location radius, short company moves, shared sets. |

| Retention & completion | Drives distribution lift and in-app monetization. | Hook in 3–5s, one beat per episode, clear stakes every scene. |

| Pay-through / next-episode | Direct revenue and deeper season progression. | End-beat promise + seamless next-ep CTA and gating flow. |

| Learning across titles | Compounds insights; lowers risk and edit time. | Core crew, style bibles, reusable wardrobe/sets, template deliverables. |

Tip: Plan shoots around a compact location radius and design episodes for retention first—clarity and momentum outperform raw view counts.

Platforms & Competition (2025)

What’s common

- Feed-like discovery with vertical swiping.

- Episode gating via coins/tickets or ad watch.

- KPIs centered on retention, completion, and pay-through.

- Season structures with many short chapters (1–3 minutes).

- Creative optimized for mobile legibility (subs, framing, pacing).

What varies

- Genre preferences by region (romance, thriller, fantasy, etc.).

- Pricing ladders, promos, and currency bundles.

- UA tactics: ad creatives, influencers, and cross-promo.

- Editorial standards, content policies, and review speed.

- Localization depth (captions, dubbing, cultural cues).

Note: IP/licensing frameworks and editorial guidelines are evolving quickly as catalogs expand. Expect consolidation (partnerships and cross-licensing) and more standardized success metrics across platforms.

Outlook to 2026 (What to Watch)

Signals and shifts that may shape vertical drama over the next year.

Interface convergence

- More “shorts-like” discovery in generalist apps.

- Faster next-episode UX and auto-advance.

- Standardized caption styles for mobile clarity.

Consolidation

- Partnerships and cross-licensing across catalogs.

- Clearer success KPIs (retention, completion, pay-through).

- Shared ad/UA infrastructure and attribution norms.

Genre diversification

- Local remakes tuned to regional tastes.

- Beyond romance: thriller, fantasy, slice-of-life.

- Hybrid formats (docu-drama, music-drama, anthologies).

Note: Keep an eye on retention-first UX, licensing frameworks, and regional genre breakouts—they tend to drive the steepest growth curves.

Vertical drama is reshaping how stories are discovered, paced, and monetized on phones. The format rewards clarity, momentum, and production logistics built for micro-binge viewing—where retention and next-episode engagement matter more than raw view counts.

As platforms refine feed-like discovery and completion-driven algorithms, creators who design for native 9:16 legibility and compact schedules will be better positioned to sustain output and iterate on what audiences keep tapping to watch next.

Related reading

- Visual guide to 9:16 storytelling: hooks, beats, and caption legibility.

- Planning by location radius: maximizing usable minutes per shoot day.

- Signals that matter: retention, completion, and pay-through.

Optional: learn how we approach native 9:16 production in Spain — Vertical Drama Series Production (9:16)